Business Insurance in and around Warren

Calling all small business owners of Warren!

This small business insurance is not risky

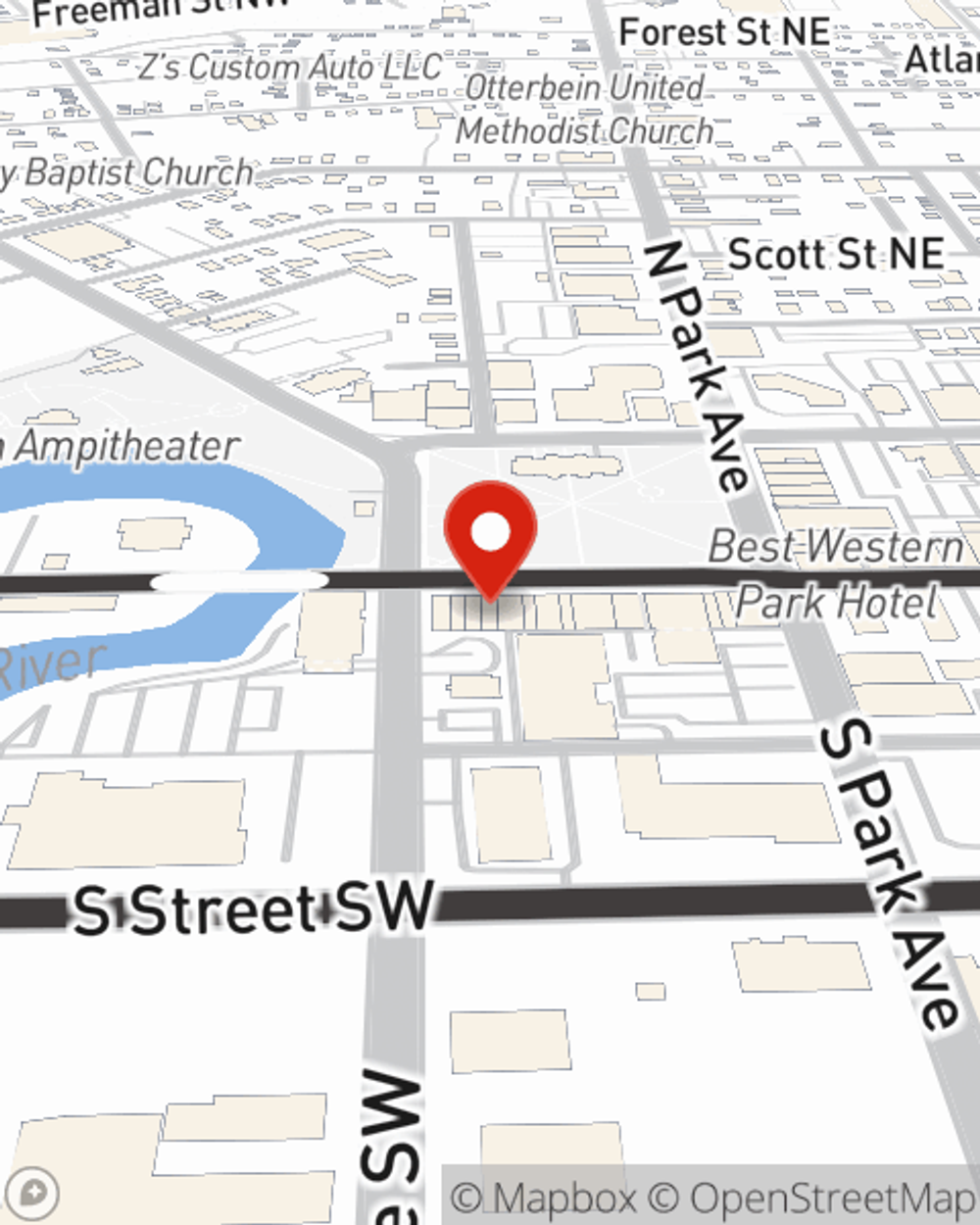

- Warren, Ohio

- Trumbull County

- Mahoning County

- Ashtabula County

State Farm Understands Small Businesses.

Operating your small business takes commitment, time, and great insurance. That's why State Farm offers coverage options like a surety or fidelity bond, extra liability coverage, business continuity plans, and more!

Calling all small business owners of Warren!

This small business insurance is not risky

Cover Your Business Assets

At State Farm, apply for the great coverage you may need for your business, whether it's an insurance agency, a gift shop or a photography studio. Agent Rob Donahue is also a business owner and understands your needs. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Get right down to business by calling or emailing agent Rob Donahue's team to review your options.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Rob Donahue

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.